First article: real estate, a random affair

The initially planned balance between rental income on the one hand and expenses (mortgage, tax, maintenance) on the other risks being disrupted by hazards. Abnormally low interest rates today will eventually rise again in the future, taxes are constantly rising, and housing regulation freaks are constantly inventing new standards to respect, which will be installed at the expense of of the lessor.

The future (2020) is the “passive house”, which will have to produce more energy than it consumes. The administration will decide the number of kWh to consume per m2 for a reasonable price, and any excess of the quota will be considered as overconsumption of energy, priced at prohibitive prices. So either the owner will carry out expensive insulation work, or he will ruin himself in heating bills, and if he tried to pass on this additional cost to the tenant, litigation would ensue.

In addition, everyone knows the problem of bad paying tenants, there is no need to insist.

Let us now move on to the case of the individual house occupied by its “happy owner”. The imponderables that await him are the same as in the diagram above of the investment property. The difference is that the designation “insolvent tenant” must be replaced by “insolvent borrower”. Most often, in fact, the buyer only pays with his personal funds a small part of the sale price of the house, so that he is in no way the owner, but only the tenant of the bank which granted him the mortgage loan. If unemployment occurs, or a long-term illness, or some unforeseen event occurs and he is unable to honor his payments: “his” property will be seized and sold at auction for a pittance.

The real estate market subject to the whims of the interest rate

The rise in interest rates is one of these unforeseen events, which has caused millions of people to lose their homes: see the infamous crisis of “subprime” loans allocated to very poor households in the United States!

This table gives the example of a household which has borrowed 130,000 over 20 years, and which has a monthly income of 3000. The monthly payment depends on the variable rate.

| CREDIT AMOUNT | interest rate | monthly payment | monthly payment/salary ratio (credit charge in relation to the household budget) |

130’000 |

3 % |

720 |

720/3000 = 24 % = comfortable |

130’000 |

7 % |

1008 |

1008/3000 = 33 % = limit |

130’000 |

12 % |

1431 |

1431/3000 = 48 % = over-indebted |

“But I entered into a fixed rate loan agreement,” some of our readers may object. We tell them that the fixed rate is certainly less uncertain than a variable rate, but that they are not protected, for three reasons.

Firstly, they must still avoid other obstacles (unemployment, soaring prices, increased charges, increased local taxes, costly repairs, upgrading, etc.) to remain solvent and honor their deadlines, especially if the inflation continues to erode their purchasing power.

Secondly, notwithstanding their own solvency, they will be victims of the insolvency of other actors in economic life. The world has slipped from recession to crisis, and is now sliding toward depression. However, if low-income households fall into poverty, and the middle classes become poorer, real estate prices will necessarily be adjusted downward. On the one hand there will be more and more people caught by the throat, forced to sell (increasing supply), and on the other hand fewer and fewer buyers capable of paying the high price (decreasing demand), especially that banks are now “cautious” and require more personal contribution and guarantees. We will continue to pay installments for a loan amount which will now be much higher than the value of the property! This phenomenon is called underwater in the United States, it is commonplace at the moment.

Even assuming that we had acquired the house in cash without taking out a loan, the problem would remain the same: the price of real estate can only plummet when the bubble bursts. And we can consider ourselves lucky if we find a buyer who has been able to get a bank loan offer, in a situation where the banks themselves are short of liquidity!

Third, the market value of the house is a function of the current interest rate. We prove it by constructing the reasoning based on the maximum monthly payment that the borrower can pay given his resources. Let's take an average household, whose income amounts to 3000. Generally, the monthly payment must not and cannot exceed ¹⁄₃ of the salary, or 1000. Note that the salary of this couple is not extendable, the monthly payment maximum 1000 is an inelastic data. Now with this investment of 1000 per month, how much money can we borrow from the bank?

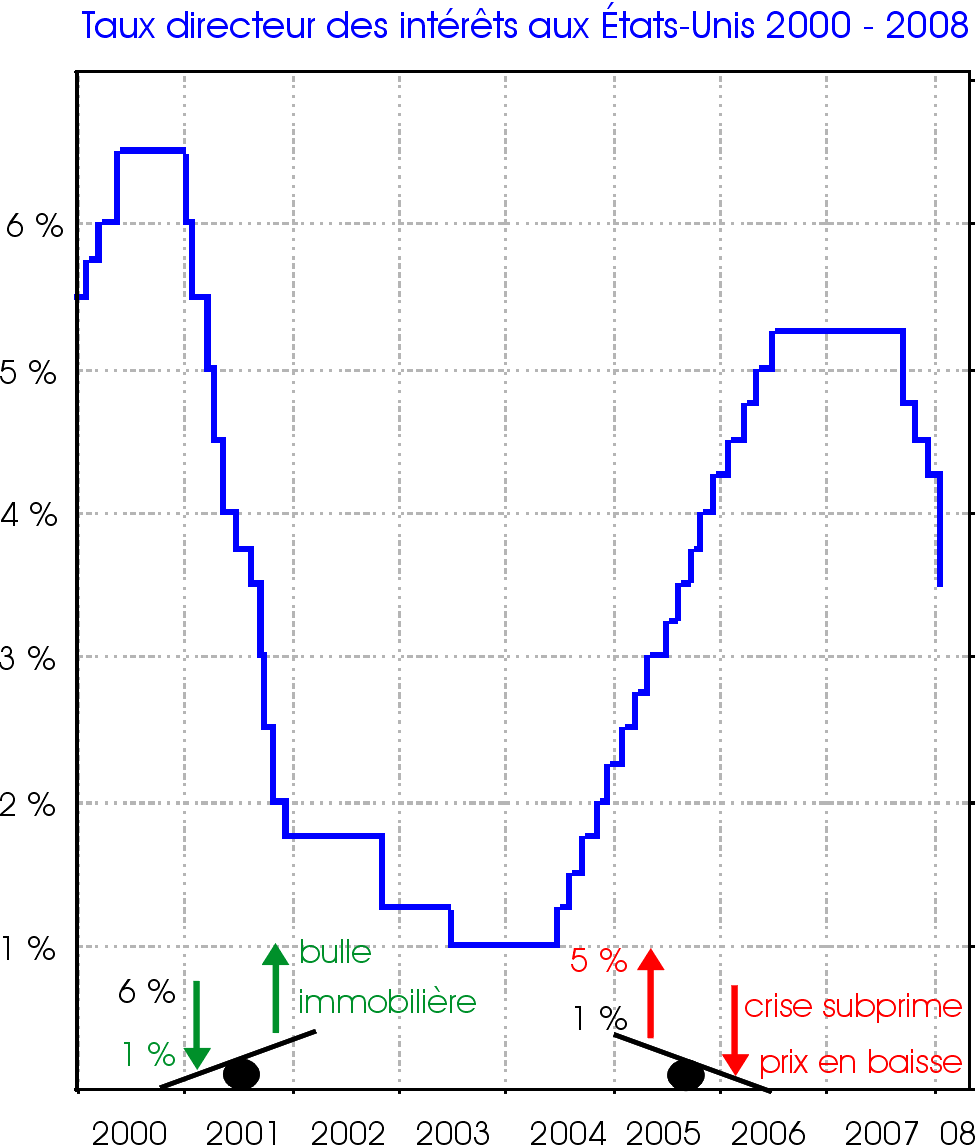

Answer: It depends on the current rate! If the rate is average (for example 7%), we will be able to buy a house at a reasonable price; if the rate is high (for example 12%), the exorbitant interest means that you can only afford to borrow a modest amount; if, on the contrary, the rate is low (for example 3%), you can easily overpay for the property, since the interest costs almost nothing. This is how the current rate determines real estate market prices! With a monthly payment of 1000 for 20 years, here are the borrowable amounts depending on the interest rate:

| credit amount | interest rate | monthly payment (240 months) |

180’000 |

3 % |

1000 |

130’000 |

7 % |

1000 |

90’000 |

12 % |

1000 |

The rise or fall in the interest rate acts as an inversely proportional lever: if the rate increases, the amount of financeable credit decreases, and vice versa. It's like a seesaw.

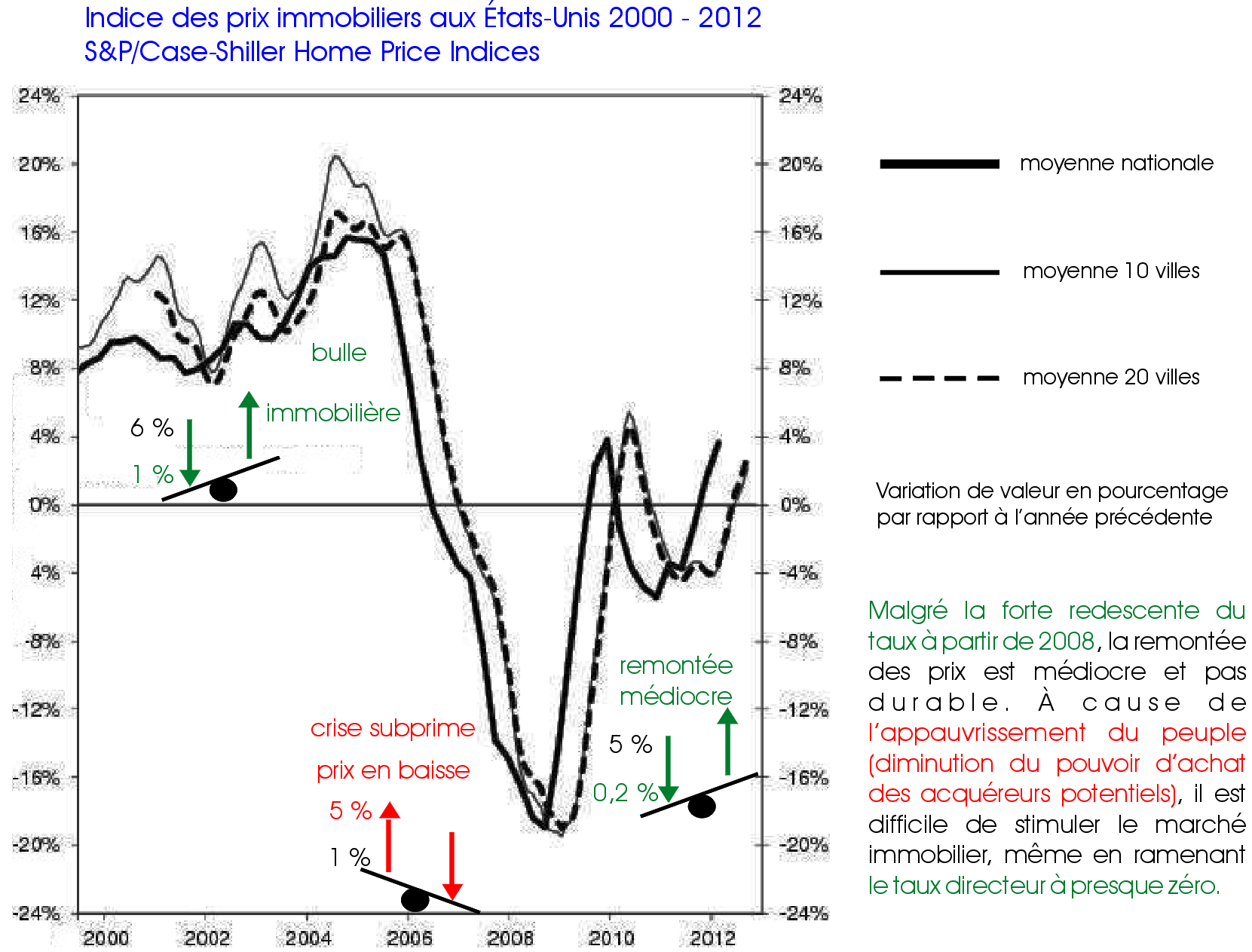

This theoretical reasoning is confirmed by practical observation. Alan Greenspan, starting in 2000, lowered the Fed's key rate by up to 1%, creating a housing bubble in the United States; from 2004, he began to raise the said rate to 5%, which resulted in the subprime crisis and the collapse of the real estate market. Since the disaster of 2008, the rate has been lowered in the hope of raising prices, but with mediocre success, such is the damage linked to subprime. Please observe these movements of the seesaw, registered below the key rate curve in the first diagram, respectively under the property price index curve in the second diagram

So, the person who thinks they are getting a good deal, because they are “taking advantage” of the current very low rates to acquire real estate, is shooting themselves in the foot. Precisely because the rates are low and these low rates allow him to borrow a maximum amount, the seller can extract the maximum from him! But when rates rise, it will cause real estate prices to fall. What good will it do for him to have “cleverly borrowed at a fixed rate”, if his house has meanwhile lost 40% of its market value?

Conclusion

In the past, stone was considered a safe bet. Today, we are all dependent on the goodwill of central banks who manipulate interest rates as they see fit, creating bubbles and crises. The real estate market falls or rises depending on the key rate, that is to say that even if we borrowed at a fixed rate, we will not prevent the strong fluctuation in the market value of the property.

Furthermore, as we have seen, the so-called “owner” is only a “tenant of the bank.” He is in no way his own master, since the State can put fiscal pressure on him at will and impose costly upgrades to building standards.

Furthermore, humanity is heading towards the greatest depression in history ever seen, and therefore real estate will be dragged to the bottom, as it was in 1929, when you could buy a building in New York for 1 kg of gold, or a building in Germany for 6 ounces of gold (156 g).

The wise investor will therefore certainly not place his confidence in real estate now, since he will lose. It would be better to convert your assets into gold and silver now, and wait patiently until the depression is in full swing, and then buy houses and buildings at a bargain price.

If, unfortunately, the crisis hits you head-on, you would be better able to cope by reselling a few coins or ingots over time, while you would not be sure of quickly finding a buyer for your property.

Next article in the series: 2° Life insurance, a “legal scam”.

Author : La rédaction d’Euporos SA

Source : www.euporos.fr

Comments

No current comments